A way to deposit checks from anywhere, at anytime by taking a picture of your check with a mobile app on your smartphone.

-

Overview

Why use Mobile Deposit?

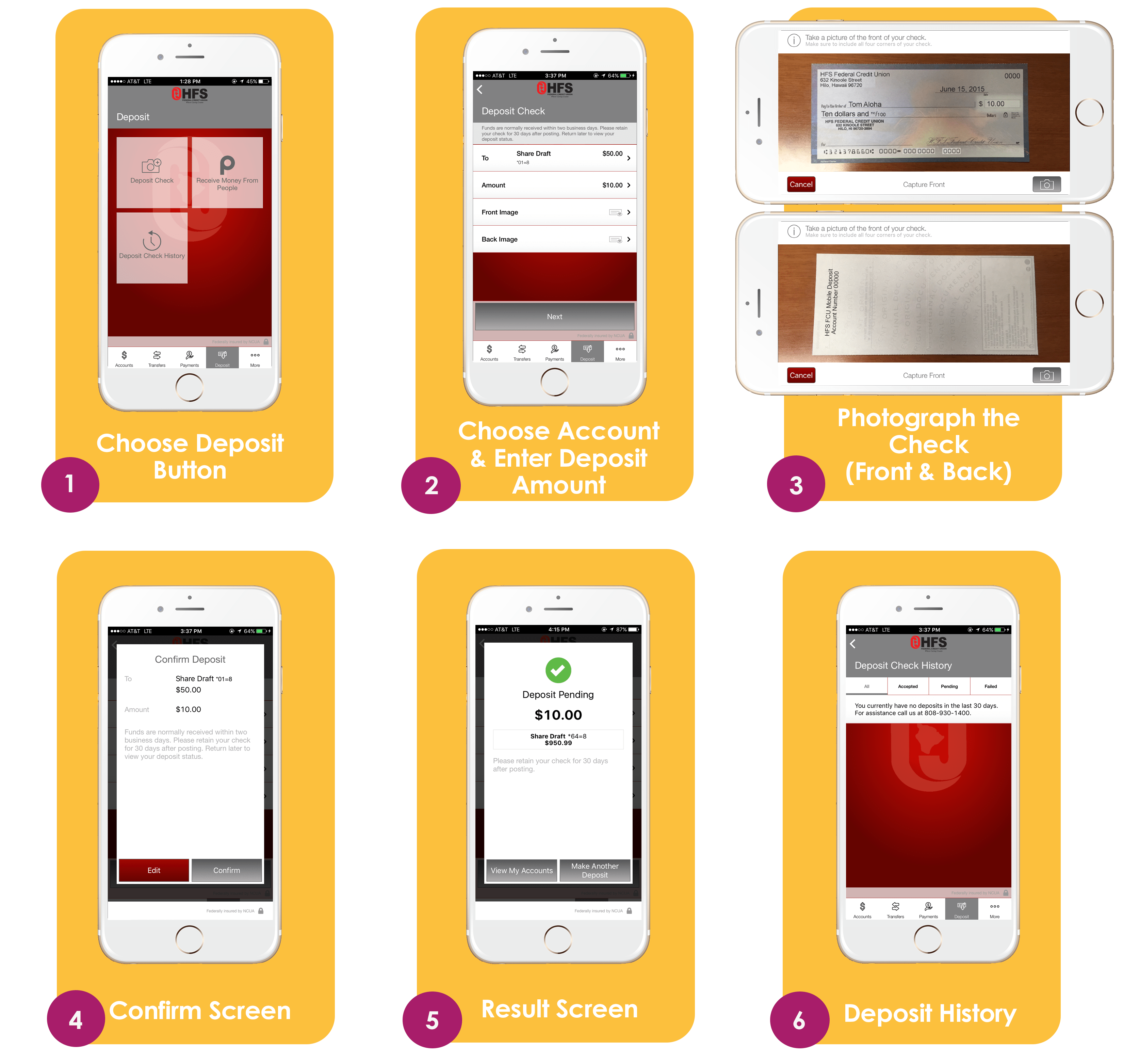

Deposit your check on the go with Mobile Deposit. Simply open the HFS Mobile Banking app on your mobile device and follow the steps below:

Before starting your mobile deposit transaction, please be sure to clearly endorse the back of the original check with "HFS FCU Mobile Deposit" and include the account number in which the check will be to be deposited.

- Deposit checks 24/7 without needing to visit the Credit Union

- Rest assured knowing your information is secure

- Deposit up to $5,000 per business day

- Mobile Deposit is free1

- Checks deposited before 8:00 pm Eastern Time (ET) will be processed and deposited on the same business day2

How to use Mobile Deposit

To deposit checks simply follow these steps:

See our Mobile Banking Service Terms and Conditions for additional information.

1You must be enrolled in HFS FCU’s Online Banking Service and Mobile Banking Service in order to use the Mobile Deposit Service. HFS FCU will charge a $25.00 returned check fee and the amount of the check against your account if payment is not received, if payment is reversed, or if the check is dishonored or returned at any time. Standard message and data rates may apply. Check your carrier plan for details.

2In most cases, checks deposited through Mobile Deposit on a business day prior to 8:00 pm ET will be processed and deposited on the same business day. Checks deposited after 8:00 pm ET will be processed on the next business day. Business days are defined as Monday through Friday excluding weekends and holidays.

Android is a trademark of Google Inc. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Amazon, Kindle Fire and all related logos are trademarks of Amazon.com, Inc. or its affiliates. -

Reviews

Mobile Deposit Reviews

My Review

[gravityform id=9 title=false ajax=true field_values="this-page-title=Mobile Deposit Review&this-page-id=914"] -

FAQ

Frequently Asked Questions

-

Is there a cost to use Mobile Deposit?

The Credit Union does not charge for making deposits through Mobile Deposit. However, fees and charges may apply to dishonored deposits and fees and charges from your phone service provider apply.

-

What do I need to write on the back of the check?

Prior to taking an image of the original check, clearly endorse the back of the check with “HFS FCU Mobile Deposit” and the account number in which the check will be deposited. Ex… “HFS FCU Mobile Deposit Acct # 12345”

-

What do I do with the check after I have completed my Mobile Deposit?

We recommend retaining the original check for at least thirty (30) days after it has posted to your account. In addition, add a note to the front of the original check such as “deposited to HFS FCU” and the date of deposit to help you remember when and where this check was deposited.

-

How long will it take for the funds to show up in my account?

In most cases, a check deposited through Mobile Deposit on a business day prior to 8:00 pm Eastern Time (ET) will be processed and deposited on the same business day. Checks deposited after 8:00 pm ET will be processed on the next business day. Business days are defined as Monday through Friday excluding weekends and holidays.

-

Are there limits to the dollar amount that can be deposited through Mobile Deposit?

Checks in excess of $5,000 are not accepted through Mobile Deposit. In addition there is a daily limit of $5,000 per business day (measured from 8:00 pm ET to 8:00 pm ET of the following business day). Amounts in excess of $5,000 may be deposited at any HFS FCU branch.

-

What types of checks can be deposited through Mobile Deposit?

Most U.S. personal checks can be deposited through Mobile Deposit. Certain types of checks such as Cashier’s Checks, Money Orders, Postal Orders, Traveler’s Checks, US Treasury Checks, and checks that require special endorsements or warrants are not accepted. Any check not accepted by Mobile Deposit may be taken to any HFS FCU branch location for deposit.

-

Is there a limit to the number of checks I can deposit each day?

There is not a limit to the number of checks that can be deposited each day, as long as all checks do not exceed the limit of $5,000 per business day.

-

Can Mobile Deposit be used on the mobile browser?

Not at this time. Currently Mobile Deposit can only be accessed through the HFS Mobile App which is available for all smartphone and tablet users who are able to download apps from the Apple®, Google Play™, or Amazon™ App stores.

-

Is there a cost to use Mobile Deposit?

Helpful Links

Questions?

Drop us a message anytime with your questions about Mobile Deposit.